Tell us about yourself.

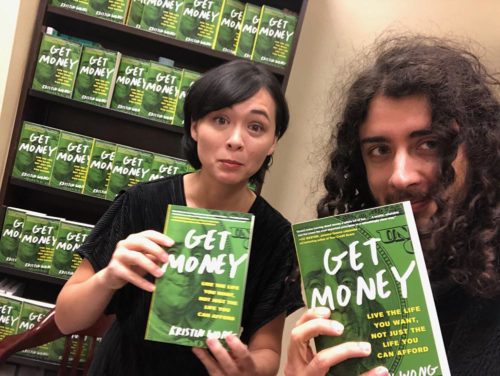

I’m a freelance writer and journalist. I regularly contribute to The New York Times Smarter Living section, and I have a money and relationship column with Medium called “Joint Accounts”. My first book, “Get Money: Live the Life You Want, Not Just the Life You Can Afford,” came out last year.

How did you get started as a journalist and a freelance writer?

I’ve always wanted to be a writer. After I graduated college, I got a full-time technical writing job in Houston. I would freelance on the side, writing everything from web copy to art gallery reviews and press releases. Then I moved to California to focus more on my freelance writing career, and my freelance income eventually surpassed any full-time salary I ever earned.

What sparked your passion to help people learn about money?

Having to figure it out myself and realizing how much it can help to have a relatable voice explain to you how this stuff works. For some reason, I can explain money in a way that gives people hope. They start to believe it’s something they can understand and master, so it makes me happy to be able to help people understand how it works.

What are some common money challenges that people have?

It’s mostly behavioral — not creating a budget but actually sticking to it. It’s the habits and behavior around money that people have a hard time with.

How does someone’s mindset impact her or his financial health?

Money has a huge impact on mental health. It can make you happy, and it can make you feel absolutely stressed and powerless. When you feel stressed and powerless, it’s hard to find the motivation to improve your mental health.

Let’s talk more about your career and journey. What were some challenges that you experienced along the way?

I still constantly struggle with the ups and downs of freelancing. Some months are absolutely abundant and you have a ton of work coming in, and some months are completely dry. You learn to adapt, but it’s still mentally exhausting.

We often see only the glimmering success stories. Let’s keep things real for our readers. What is your process like? What are some of the struggles and hardships?

One of the biggest struggles is the inconsistency of work and, consequently, income. After almost a decade of freelancing, I have the financial part figured out and it mostly comes down to covering your ass with massive savings and living well below your means. That takes time and a lot of work. But the inconsistency of work is still a pain. If you don’t have a consistent client or you’re not on a retainer, it feels like “feast or famine.” Some months you’re completely bogged down with work and stressed out, and some months you’re lacking so much work that you’re stressed out. I’ve learned to go with the flow and understand that it’s part of the process, but it does still get stressful.

How have you stayed motivated throughout your journey?

I’d like to say it was some super inspirational moment or quote that kept me going, but honestly? Money. I’m very money-motivated, so having a fair amount of savings — what I called a “career switch fund,” gave me the mental bandwidth to be able to stay on track with my goal to be a freelance writer despite the ups and downs. I used my full-time job to fund my career switch.

Who are some of your mentors?

My mentor is Emilie Wapnick, author of How to Be Everything. She gave a TED talk on multipotentiality — the idea that you don’t have to just pick one thing to “be” in life. You don’t have to “niche down.” The first time that I heard that idea, it changed everything. I always thought if I wanted to be a writer, I couldn’t do anything but write. It was like someone gave me permission to pursue my other passions, and even better, find a common thread in all of them. Aside from her, I have a solid group of work-turned-real-life friends that support my work wholeheartedly.

What are some mistakes you’ve made along the way?

Not paying taxes my first full year of freelancing. Pay your quarterly taxes, freelancers!

What was your big breakthrough moment?

Forcing myself to negotiate with clients and significantly increasing my income.

Did you almost give up at any point? What led up to that? How did you persevere?

I still sometimes think about giving up, because again, the inconsistencies can be so frustrating. Sometimes it would just be nice to know that I make X dollars a year, instead of saying, “I’m on track to make X dollars a year” but never really knowing. I keep thinking, “This isn’t sustainable,” but I guess it must be, because I’ve been doing this for a decade.

What is something you wish you knew when starting out?

How important it is to negotiate. For a long time, I had what some people call a “starving artist” mindset, where I just assumed that being a writer meant I was going to be broke forever. Instead of questioning this, I just went with it. I accepted low- or no-paying gigs and never asked for more. When I learned to negotiate, my income increased significantly, and I wish I would have learned this skill sooner.

Tell us more about your book, “Get Money.”

“Get Money” is an actionable, conversational guide to personal finance. It goes beyond the basics and the logistics of being good with money and discusses the psychology behind it. Most of us feel like we have very little, if any, control over our finances. And in many cases, that may actually be true — there are so many things about money that we have no control over, but I think the key to being good at managing it, at least, is to feel like you have some sense of power or control over it, even in small ways. So at its core, the book is about helping you find that power.

What are some tips to help our readers get their financial houses in order?

This is a very basic tip, but meticulously tracking your spending for a month is a good start. I wrote more about this here.

What does “audacity” mean to you?

Doing the things you want to do and not just the things you think you’re supposed to do.

Find Kristin Wong at:

www.kristinwong.com (click here to sign up for her newsletter)

Twitter and Instagram: @thewildwong